- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- Farmer's Almanac

- USDA Reports

Vertex Pharmaceuticals Stock Outlook: Is Wall Street Bullish or Bearish?

/Vertex%20Pharmaceuticals%2C%20Inc_%20HQ%20in%20Boston-by%20Tada%20Images%20via%20Shuttershock.jpg)

With a market cap of $114.8 billion, Vertex Pharmaceuticals Incorporated (VRTX) is a biotechnology company specializing in treatments for cystic fibrosis (CF). Its portfolio includes leading CF treatments such as Trikafta/Kaftrio, Symdeko/Symkevi, Orkambi, and Kalydeco, while its pipeline targets other conditions like sickle cell disease, type 1 diabetes, and APOL1-mediated kidney disease.

Shares of the Boston, Massachusetts-based company have underperformed the broader market over the past 52 weeks. VRTX has decreased marginally over this time frame, while the broader S&P 500 Index ($SPX) has gained 11.2%. However, VRTX stock has risen 9.4% on a YTD basis, outperforming SPX's marginal gain.

Looking closer, the drugmaker has outpaced the Health Care Select Sector SPDR Fund's (XLV) 8.8% decline over the past 52 weeks.

Shares of VRTX tumbled 10% following its weaker-than-expected Q1 2025 revenue of $2.8 billion and adjusted EPS of $4.06. The earnings miss was driven by a $190 million rise in R&D expenses and a 16% increase in overhead costs, as well as a $379 million asset impairment charge related to halting the VX-264 diabetes program. Additionally, Trikafta sales faced a $100 million headwind in Russia from an illegal copy product.

For the fiscal year ending in December 2025, analysts expect VRTX’s EPS to grow significantly year-over-year to $15.67. The company's earnings surprise history is mixed. It topped the consensus estimates in two of the last four quarters while missing on two other occasions.

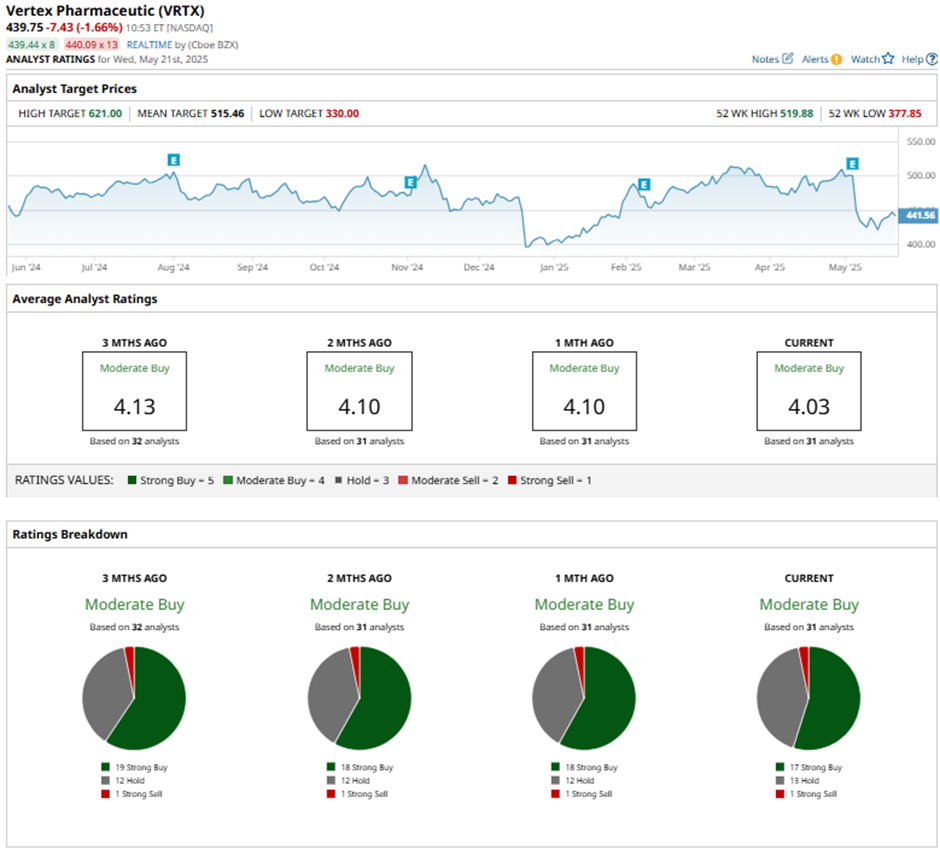

Among the 31 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 17 “Strong Buy” ratings, 13 “Holds,” and one “Strong Sell.”

This configuration is less bullish than three months ago, with 19 “Strong Buy” ratings on the stock.

On May 7, Goldman Sachs raised Vertex Pharmaceuticals’ price target to $621, maintaining a “Buy” rating. Despite a slight decline in Trikafta sales, the firm highlights growth potential from new launches, Alyftrek and Journavx.

As of writing, VRTX is trading below the mean price target of $515.46. The Street-high price target of $621 implies a potential upside of 41.2% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.